Who can claim?

The qualifying purchaser

In order to be eligible for a VAT refund in South Africa, the individual must be a:

- Non-resident

- Tourist

- Foreign enterprise

- Foreign diplomat

- An international organisation established in terms of a Constitutive Act.

- Organisation which is like an association not for gain or a welfare organisation

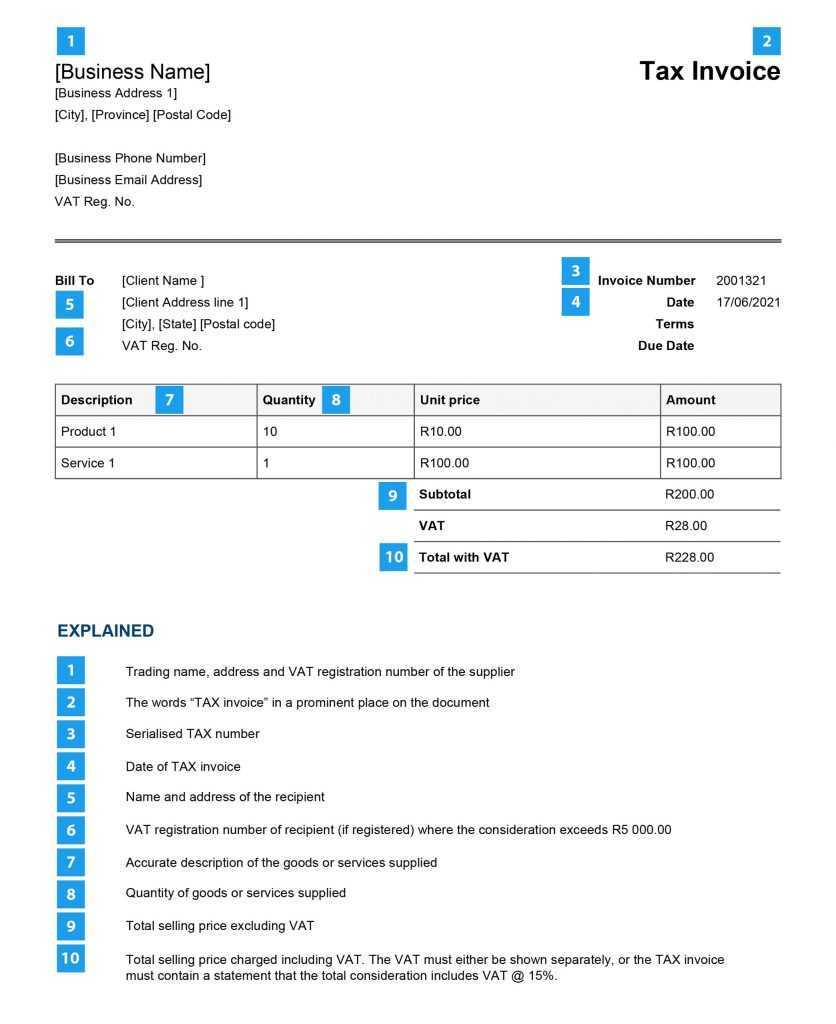

Tax Invoice Example

Qualifying Purchaser

A NON - RESIDENT

A natural person who is not a South African passport holder, who is not in South Africa at the time of the supply, who is a permanent resident of an export country and who orders movable goods from South Africa and has such goods exported on his/her behalf by his/her cartage contractor (a person whose activities include the transportation of goods and includes couriers and freight forwarders).

Please note that if you are residing in South Africa for more than the permissible 90 days allowed for tourists, you must provide a valid visa clearly indicating the reason for your extended stay.

A TOURIST

A person who is not a South African passport holder, who travels to South Africa on a non-resident travel document and exports movable goods from South Africa in accordance with the provisions of the Scheme and is a permanent resident of an export country who is on a temporary visit to South Africa; or who is South African passport holder who is a permanent resident of an export country, residing in that export country at the time of the purchase.

A FOREIGN ENTERPRISE

A FOREIGN DIPLOMAT

INTERNATIONAL ORGANISATION

ORGANISATION WHICH IS LIKE AN ASSOCIATION NOT FOR GAIN OR WELFARE ORGANISATION

An Organisation which is like an association not for gain or a welfare organisation which is registered as such in that export country; and established in an export country and not conducting any activity in the Republic and who is exporting the movable goods in accordance with the Scheme.

Sanctioned Countries

| Country | Risk Type |

|---|---|

| Afghanistan | No-Go On Payments |

| Belarus | No-Go On Payments |

| Cuba | No-Go On Payments |

| Gaza Strip | No-Go On Payments |

| Iran, Islamic Republic of | No-Go On Payments |

| Myanmar | No-Go On Payments |

| North Korea | No-Go On Payments |

| Russian Federation | No-Go On Payments |

| South Sudan | No-Go On Payments |

| Syria | No-Go On Payments |

| Venezuela | No-Go On Payments |

| West Bank (Palestinian Territory, Occupied) | No-Go On Payments |

| Republic of Congo | No-Go On Payments |

| Republic of Guinea-Bissau | No-Go On Payments |

| Palenstine | No-Go On Payments |

Hi Risk Countries

Please note the countries listed below detail countries that the bank will not process payments to or are either considered high risk.

In the event a country is considered high risk, the bank is obliged to follow enhanced due diligence which include but not limited to individual and entity screening and sanctions review, which may impact on the standard settlement times or even result in a payment not being processed.

The bank reserves the right to update the list and cannot be held for responsible for any losses due to changes that may occur due to restrictions.

| Country | Risk Type |

|---|---|

| Albania | High |

| Barbados | High |

| Brazil | High |

| Burkina Faso | High |

| Burundi | High |

| Cambodia | High |

| Cayman Islands | High |

| Central African Rep | High |

| Congo, the Democratic Republic | High |

| Eritrea | High |

| Gibraltar | High |

| Guinea Bissau | High |

| Haiti | High |

| Iraq | High |

| Jamaica | High |

| Jordan | High |

| Kenya | High |

| Kosovo | High |

| Lebanon | High |

| Libya | High |

| Mali | High |

| Morocco | High |

| Mozambique | High |

| Nicaragua | High |

| Nigeria | High |

| Pakistan | High |

| Panama | High |

| Philippines | High |

| Senegal | High |

| Somalia | High |

| Sri Lanka | High |

| St Maarten | High |

| Trinidad & Tobago | High |

| Turkey | High |

| Uganda | High |

| United Arab Emirates | High |

| Vanuatu | High |

| Western Sahara | High |

| Yemen | High |

| Zimbabwe | High |